Table of Contents

- Table of contents will be generated automatically when the page loads.

Tokenization has become a buzzword nowadays. Have you ever thought why we can easily order food, book flights, and make video calls across continents, yet transferring money or buying stocks still requires days to settle? Markets are transferring trillions of dollars, yet processes such as settlement still rely on outdated ecosystems, resulting in surprisingly long turnaround times. In this evolving world, time is the most important aspect, as it carries a financial cost.

Traditionally, we relied on the financial system to store and transfer value. Though the entire world has moved to digitalization, money, assets, and ownership still travel through slow, fragmented, and expensive systems.

When you buy stock through a platform, it feels instantaneous. However, completing the transaction by transferring ownership takes considerable time. Real estate transactions can drag on for weeks, given the involvement of intermediaries like banks, the property registry, and other fiscal or statutory bodies. Each intermediary charges fees and contributes to delays in completing the transaction.

You must ask yourself

- There must be a more efficient way, correct?

- Could we explore why it takes several days to settle a stock trade?

- Why can’t you invest in real estate without hassels like cumbersome legal processes?

- Why is transferring ownership still so difficult across borders?

These are not tech problems; the actual problem lies with structures, which is exactly what tokenization is here to fix.

Before explaining what tokenization is, we should understand why the world needs tokenization.

The Old System Is Slowing Us Down

Although the financial system is built on technology, the process is still associated with paper, stamps, and signatures. We access banks and brokerage firms via apps to initiate transactions, but the structure remains the same as before.

Let’s look at the key pain points:

1. Settlement is still slow.

Transactions take a longer time to settle in most financial markets.

Let me walk you through the process of buying stock. Assume you buy a stock via an application or trading platform. Then your broker confirms it, and a clearing house validates everything. A transfer agent updates the ownership records, and banks facilitate the settlement of funds between parties.

- Stock trade takes T+2 days: it is almost two business days after the trade to finalize it.

- Cross-border payments can take 2–5 days via systems such as SWIFT, during which several nostro banks are involved.

- In real estate transactions, the transfer of ownership can take weeks or even months.

This delay persists within the ecosystem, increasing risks and imposing costs. For example, a party could go bankrupt before a transaction settles.

2. Layers of Intermediaries

Today’s asset transfers involve multiple third parties:

- Custodians

- Clearing houses

- Transfer agents

- Brokers

- Escrow services

Each layer increases costs, causes delays, and can lead to failures. These middlemen are not free; they will charge a commission/fee.

3. Lack of Transparency

Ownership records are often registered in databases where no one can view them. If you want to verify the ownership of a bond or a property, you often must go through a legal or bureaucratic procedure.

This causes information asymmetry, which causes imbalance between parties involved, and that can create unfair advantages and a lack of transparency.

4. Limited Access

Today, only a limited number of people can invest in certain asset classes like private equity, fine art, or commercial real estate.

Why? It is too expensive because the entry cost is high and the process is complex.

Tokenization offers a new path forward.

From Paper to Programmable: The Evolution of Value

Let’s step back and look at how we have exchanged value over time:

| Era | Form of Ownership | Features |

| Paper-based | Stock certificates, real estate deeds | Manual, slow, vulnerable |

| Electronic | Centralized databases (banks, brokers) | Faster, but fragmented |

| Programmable | Tokens on blockchain | Real-time, transparent, global |

In the same way that we moved from letters to emails, tokenization transfers ownership to a programmable form. Rather than having ownership in paper or central databases, it is possible to digitalize assets in a blockchain where they can be traded, verified, and transferred in real time.

This is not about “crypto hype.” It is about upgrading the way we manage value in the same way that the cloud transformed the way we manage files.

What Tokenization Solves: Real-World Examples

Real Estate

Investing in real estate has always been both costly and time-consuming. Tokenization changes that.

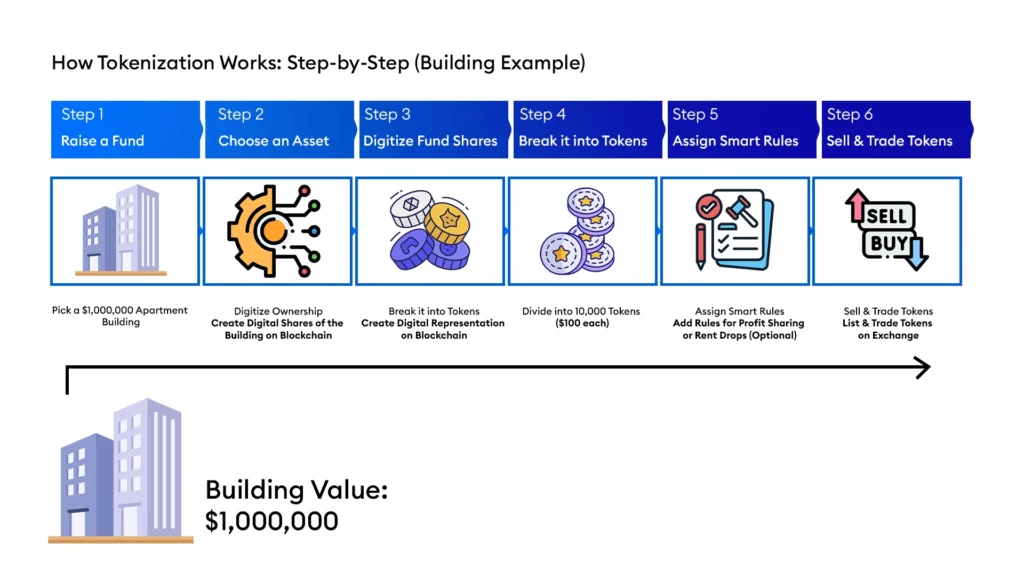

Suppose it is a $ 1 million building in New York. Only a wealthy investor or institution could own it. However, it is possible to tokenize that building into 10,000 tokens, each valued at $100, where even retail investors can now own a piece.

Ownership could be verified on chain. Smart contracts can be used to distribute rent and dividends among the investors. Even reselling your stake can happen in seconds, not weeks.

Private Equity and Hedge Funds

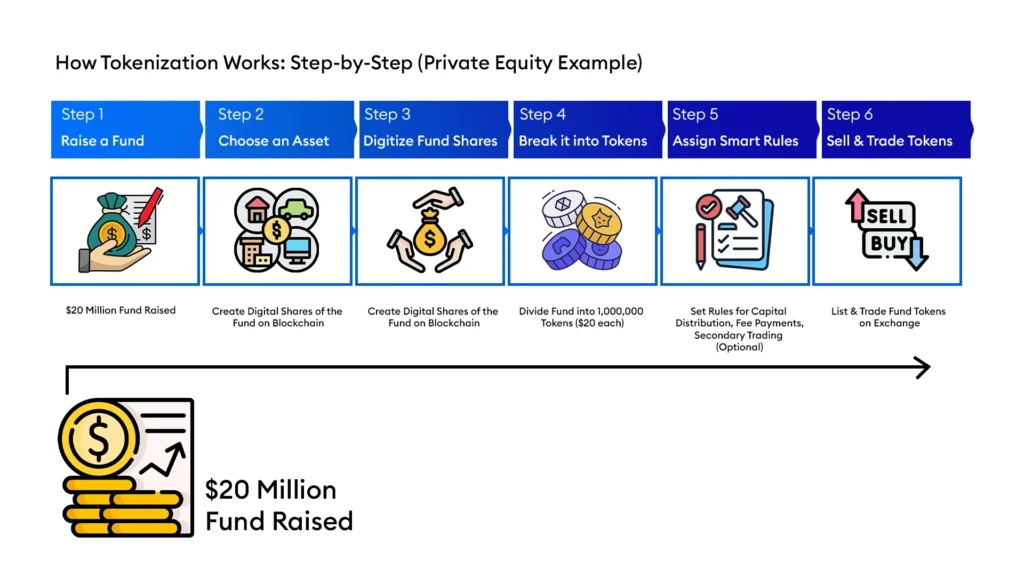

To invest in a private equity fund is not affordable at all, often requiring a considerable minimum investment (e.g., $100,000 or more) with a multi-year fund lockup.

Through tokenization, a private equity fund can be divided into smaller units where investors can buy units (e.g., Investors will be able to purchase a unit/share at 20 dollars). These units are tradable in the secondary market and open access to more investors, increasing liquidity in the market.

Commodities and Goods

A shipment of gold, oil, or grain can be tokenized by commodity firms. Each unit is digitally tracked from production to sale. This brings supply chain traceability and trust, and eliminates the paper-intensive logistics.

The brands of luxury goods are also testing the system of tokenizing handbags, watches, and sneakers to demonstrate their authenticity and be able to resell securely.

Tokenization Is a System-Level Upgrade

This is not just about putting stuff on the blockchain. The concept of tokenization is a paradigm shift in our rights, rules and records.

Let’s compare old systems vs tokenized systems:

| Feature | Traditional | Tokenized |

| Ownership Records | Private, fragmented | Public, unified |

| Access | Restricted | Open and global |

| Trading Hours | Limited (9–5, Mon–Fri) | 24/7/365 |

| Settlement | Delayed (T+2, weeks) | Instant or near-instant |

| Minimum Investment | High | Fractional, inclusive |

Transactions need not be verified manually by smart contracts. Code enforces rules automatically. This reduces human error and speed up processes.1

This is why the World Economic Forum calls tokenization “the foundation of next-generation markets.”

Who’s Already Doing It?

Tokenization is no longer just a startup idea. Currently, major institutions are already testing and deploying real-world projects:

- BlackRock launched a tokenized money market fund in 2023 on Ethereum.2

- JPMorgan tokenized $20 billion in assets on its Onyx platform.3

- HSBC, UBS, and DBS Bank are working with Singapore’s Monetary Authority on Project Guardian to tokenize bonds and deposits.4

- The European Investment Bank issued a €100 million digital bond on blockchain.5

The momentum is building fast. According to Boston Consulting Group, up to $16 trillion in assets could6 be tokenized by 2030.

Tokenization Is Not Crypto Speculation

Let’s address the confusion: tokenization and cryptocurrency are not the same.

- Crypto assets (like Bitcoin) are native digital currencies.

- Tokenized assets are real-world assets represented digitally.

The tokenized stock remains a stock. Even a tokenized bond will still get an interest. These assets are regulated and supported by the law.

Tokenization simply changes the structure and ecosystem behind the traditional process, just like email did not change writing, but it changed how we send and receive it.

Key Takeaways

- Traditional structures and ecosystems in the financial market are slow, expensive, and exclusive.

- Tokenization makes real-world assets digital, programmable, and accessible.

- Tokenization can enhance market liquidity through affordability and eliminate inequality associated with financial investment, as a wide spectrum of investors now can access high-end asset classes, whereas traditionally, accessibility was limited to high-net-worth investors.

- It eliminates intermediaries, lowers costs, and speed up transactions.

- Real estate, funds, art, and commodities can all be tokenized today.

- Big institutions and regulators are already building on this shift.

- This is not about crypto hype, it’s about making finance work better for everyone.

- reports.weforum.org:https://reports.weforum.org/docs/WEF_Asset_Tokenization_in_Financial_Markets_2025.pdf ↩︎

- securitize.io: https://securitize.io/learn/press/blackrock-launches-first-tokenized-fund-buidl-on-the-ethereum-network ↩︎

- coindesk.com: https://www.coindesk.com/business/2023/10/11/jpmorgan-debuts-tokenized-blackrock-shares-as-collateral-with-barclays ↩︎

- mas.gov.sg: https://www.mas.gov.sg/news/media-releases/2023/mas-partners-financial-industry-to-expand-asset-tokenisation-initiatives ↩︎

- eib.org: https://www.eib.org/en/stories/cryptocurrency-blockchain-bonds ↩︎

- web-assets.bcg.com: https://web-assets.bcg.com/1e/a2/5b5f2b7e42dfad2cb3113a291222/on-chain-asset-tokenization.pdf ↩︎