Table of Contents

- Table of contents will be generated automatically when the page loads.

Banks had been the primary lending institutions over the years. But that’s changing fast. Today, the share of lending is increasingly private credit, i.e., by non-bank entities such as asset managers, debt funds, and private equity fund affiliates.

This shift is not a conflict. It is a redesign of the flow of credit in the financial system. This change presents both opportunities and concerns for investors.

How We Got Here: A Crisis Created the Opening

The 2008 financial crisis made it more difficult for banks to lend due to new regulations. The new regulations, such as Basel III and Dodd-Frank, required banks to hold more capital. These changes led banks to withdraw some lending, particularly to mid-sized firms.

This was the moment when private credit began to play a significant role.

In the year 2000, less than half a million dollars in credit was in the hands of the private sector. It had topped the 1.6 trillion mark by the close of 2023, according to Preqin. It is predicted to grow to 2.8 trillion by 2028.

Banks were not being supplanted by private credit. It rather occupied the void created by banks. This situation is not about identifying winners and losers; rather, it is about developing a new system.

Why Private Credit Keeps Growing

Banks struggle to match the speed and flexibility of private credit.

For example, private lenders can close deals more quickly. They can tailor their terms to suit a borrower’s needs. That comes particularly in handy for private equity deals or midsize companies that require quick funding.

The following is what’s appealing about private credit:

- Bespoke loan terms

- Faster approvals

- Less regulation

- Floating interest rates are beneficial in a rising rate environment.

According to S&P Global, private lenders financed 77 per cent of leveraged buyouts worldwide in 2024.

Are Banks and Private Credit Competing? Not Exactly

People may believe that private credit is stealing business from banks. But the truth is more complex.

Banks are not obliged to be antagonistic to private credit; they tend to co-operate with it.

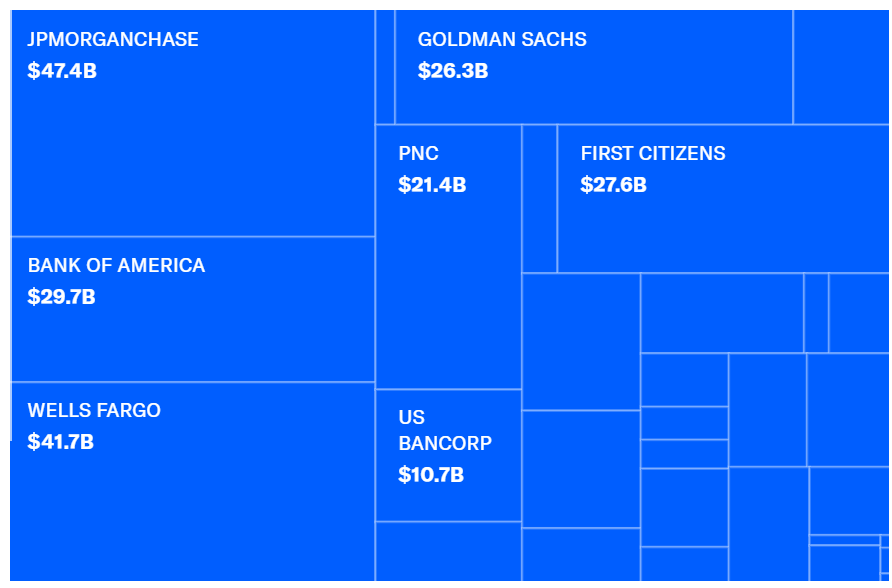

U.S. banks have provided well over $300 billion to private credit funds. The result is high returns for banks; some have an ROE of 29 per cent, compared with traditional loans, which have an ROE of only 8 per cent.

Other banks have gone so far as to establish their own privately owned credit platforms. Others co-invest with asset managers.

In brief, the credit market is no longer divided between banks and private credit.

What This Means for Investors

Private credit can offer strong returns. But it also comes with risks.

Pros:

- Higher yields than traditional bonds

- Diversification for fixed-income portfolios

- Floating rates that adjust with inflation or central bank hikes

Cons:

- Less transparency: loans aren’t traded on open markets

- Lower liquidity: investors can’t always exit quickly

- Valuation lag: prices don’t update as often as public bonds

In 2025, MSCI discovered that loan write-downs in private credit increased by threefold over three years. That is how even mature private companies can be strained by rising interest rates.

Regulators are closely monitoring the situation. The BIS (Bank for International Settlements) has issued a warning, highlighting the tight integration of banks and private credit. One shock in one may strike the other.

The Credit Market Is Evolving

It is not a tale of banks being overtaken. It is a tale of the transformation of the credit system.

The shift from private credit to mainstream credit is observed. Banks have not been eliminated; they are simply in new forms. Banks may not provide all types of loans, but they often finance or collaborate with those who do.

This new structure is influencing the flow of money, risk sharing, and how investors should consider credit.

Key Questions for Investors to Ask

Investors should closely examine their exposure as this change continues. Consider these questions:

- How does your private credit position fall in your portfolio: core fixed or options?

- What is your exposure to liquidity risk in private credit?

- Are your risk models slower to respond to pricing changes and to detect hidden leverage?

- Do you have more connections between your public and private credit holdings than you believe?

Understanding this new system is crucial. It is important to make intelligent investment decisions in the decade to come.