Catenaa, Friday, January 16, 2026 – Intel has extended its gains in the first three weeks of 2026, with the stock up by over 28%, showing investors are increasingly optimistic about the chipmaker gaining new foundry customers.

The stock is over 28% to start 2026, the third-best performance in the S&P 500 Index. After an 84% rally in 2025, the shares are near their highest level in two years, recovering from a 60% drop in 2024 when Intel appeared to be falling behind its rivals, who were capitalizing on the AI boom.

A range of catalysts is driving the optimism: an improving financial outlook, new confidence from Wall Street as seen in recent analyst upgrades, speculation about new foundry customers, and even enthusiasm around the company’s potential to be a winner in President Trump’s “America First” campaign.

Intel reports its fourth-quarter earnings after the bell on January 22, and investors will be looking for signs of progress. Analysts at firms like Citi and KeyBanc have recently raised their ratings on the stock, which now has the most buy-equivalents in more than a year.

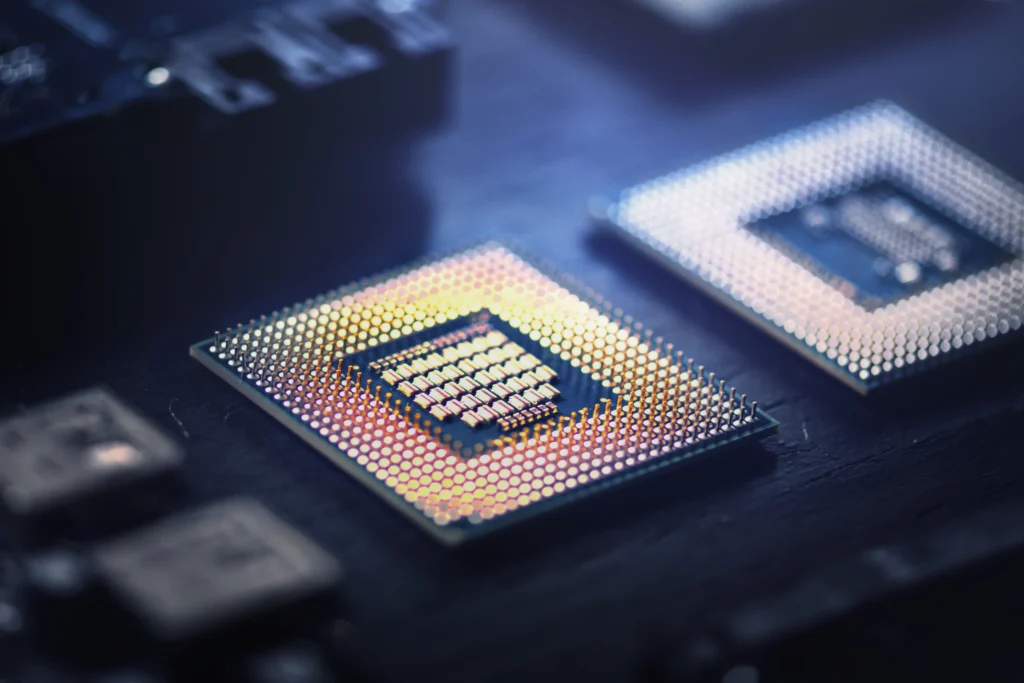

Intel is also benefiting from demand for its central processing unit, CPU, chips for PCs and data centers, which need CPUs in addition to the graphics processing unit, or GPU, chips that Nvidia Corp. and other semiconductor makers provide.

The most unpredictable factor driving Intel’s rally is its ties to Trump, who last year brokered an investment by the US government after criticizing Chief Executive Officer Lip-Bu Tan.

Nvidia and SoftBank Group have also invested in Intel, helping to shore up its balance sheet.

Intel’s status as a rare maker of chips on US soil could also be giving the stock a boost, as speculation rises that China may act on Taiwan, which would likely disrupt the most important foundry operator, Taiwan Semiconductor Manufacturing Co.