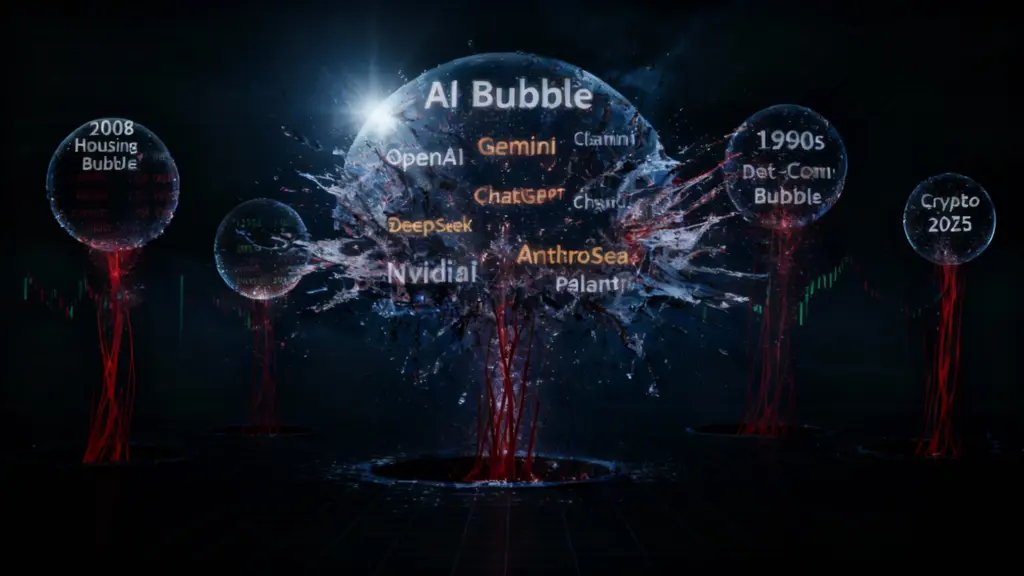

Catenaa, Saturday, November 15, 2025-After a period of rapid gains, artificial intelligence stocks are facing increased scrutiny as investors question whether soaring valuations match actual usage and profits.

The Nasdaq posted its worst week since April, with shares of AI-focused companies like Palantir Technologies and Nvidia falling 11% and 7%, respectively, despite continued strong demand for AI products.

Analysts note that corporate adoption of AI tools has slowed, with surveys showing usage by large U.S. companies dropping from 14% in June to under 12% in August.

Concerns over AI systems’ reliability, hallucination risks, and unsustainable capital spending have intensified caution in markets.

Global investment in AI remains massive, with OpenAI, Nvidia, Softbank, Oracle, Alibaba, and Tencent pledging hundreds of billions to support infrastructure and chip development.

AI-related stocks have added an estimated $17.5 trillion in market value over the past two years, fueling record valuations for Nvidia, Microsoft, and other tech leaders.

Despite high valuations, some economists warn the hype may be outpacing tangible business impact. OpenAI, for example, reported $3.7 billion in revenue last year against $8–9 billion in expenses.

Venture capital funding for private AI firms has declined 22% quarter-over-quarter, reflecting increased investor caution.

Experts suggest a market correction rather than a full collapse is likely, as firms focus on measurable returns and ROI from AI projects.

Nvidia’s upcoming earnings on November 19 are seen as a key indicator of whether the AI boom can sustain its momentum.