Catenaa, Wednesday, December 24, 2025- Warren Buffett’s Berkshire Hathaway reduced its Apple holdings and purchased shares of Alphabet during the third quarter, signaling a shift toward artificial intelligence-driven investments.

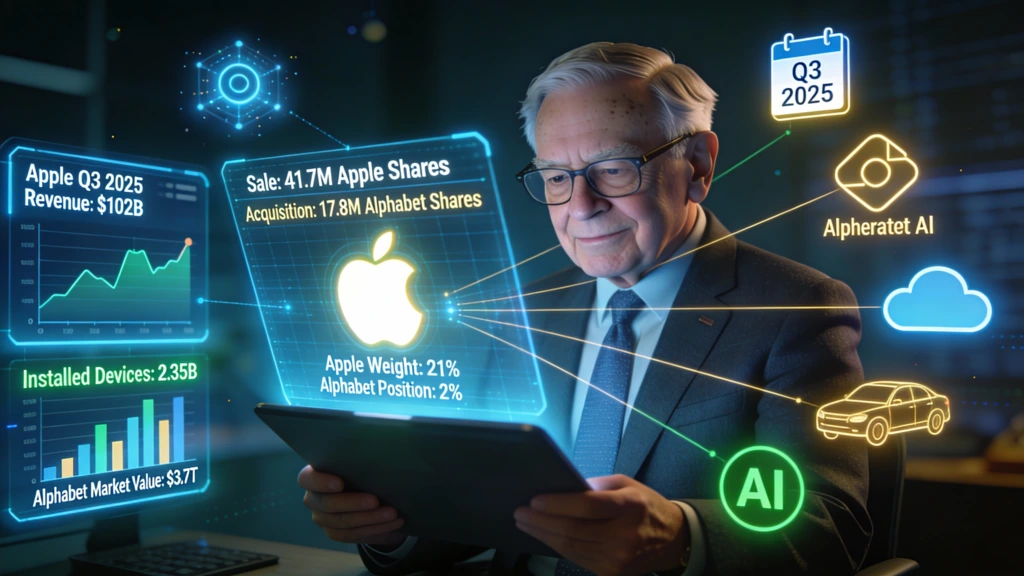

Berkshire sold 41.7 million Apple shares, lowering the company’s portfolio weighting to 21%, down 74% over two years. Apple reported $102 billion in revenue for the September quarter, an 8% increase from the previous year, supported by strong iPhone, Mac, and services sales.

Non-GAAP net income rose 13% to $1.85 per share, aided by modest margin growth and ongoing share buybacks. Apple’s installed base exceeds 2.35 billion devices, giving the company a platform to expand consumer adoption of artificial intelligence.

Its Apple Intelligence suite, introduced last year, currently offers free generative AI features for newer devices, with paid options expected in coming years.

Berkshire also acquired 17.8 million shares of Alphabet, a smaller position at 2% of the portfolio. Alphabet has returned 12,180% since its 2004 IPO and carries a $3.7 trillion market value, making it the third-largest company globally.

Buffett’s investment reflects a willingness to enter technology stocks previously avoided. Alphabet’s artificial intelligence potential spans digital advertising, cloud computing, and autonomous driving, creating multiple revenue streams for growth.

The moves show Berkshire’s cautious reallocation in technology, reducing exposure to high-priced Apple shares while embracing opportunities in AI through Alphabet.